I wrote this article a few months back as I was curious in knowing how did an unknown and on-the-verge bankruptcy consumer-beverage company rose to what’s known as a globally recognized premium functional energy drink, standing at the side of Red Bull and Monster Beverage.

If you did benefit from this article, I do kindly ask that you share it around so that this could reach a lot more people who may benefit from this.

Great, let’s head right into it.

Summary

Celsius is a global leading functional energy drink that health-minded consumers consume on a regular basis.

Celsius was mismanaged in the past which led to the delisting of the company in 2010.

Carl De Santis, the major shareholder of the company, single-handedly forced the old management team out of the company and brought in a new team to lead the turnaround of the company, which eventually got it uplisted in the NASDAQ capital market in 2017.

Driven by improved fundamentals and multiple expansions, Celsius has delivered life-changing returns for its shareholders.

Overview

Celsius Holdings (NASDAQ: CELH) is a remarkable turnaround company that was once heavily mismanaged and fell out of the NASDAQ capital market in 2010. However, it has then come back and become one of the world’s leading energy drinks besides Monster Beverage (NYSE: MNST) and Red Bull.

The turning point came when Carl De Santis, the largest shareholder of the company brought in a highly competent management team, including CEO Gerry David and CFO John Fieldly. They successfully resurrected the company and turned it into a growth company that generated life-changing returns for its shareholders.

On The Brink Of Death

Exorbitant Cash Burn

Celsius went public for the first time in 2008, led by the former CEO, Stephan Haley, and the drink was first marketed as a unique calorie-burning drink company that is clinically proven to help with weight loss. There are little to no calorie-burning drinks in the market that are backed by scientific research, therefore they had a very unique product.

But the issue was they weren’t able to monetize it.

From 2008 to 2010, the management team embarked on a strategy to pursue rapid expansion and achieve brand awareness. They did this through direct-to-retail (“DTR”) and direct-store-delivery (“DSD”) distribution models and undertook aggressive marketing campaigns like TV and radio advertising to push their products to the stores of many well-known retailers.

Deteriorating Financials

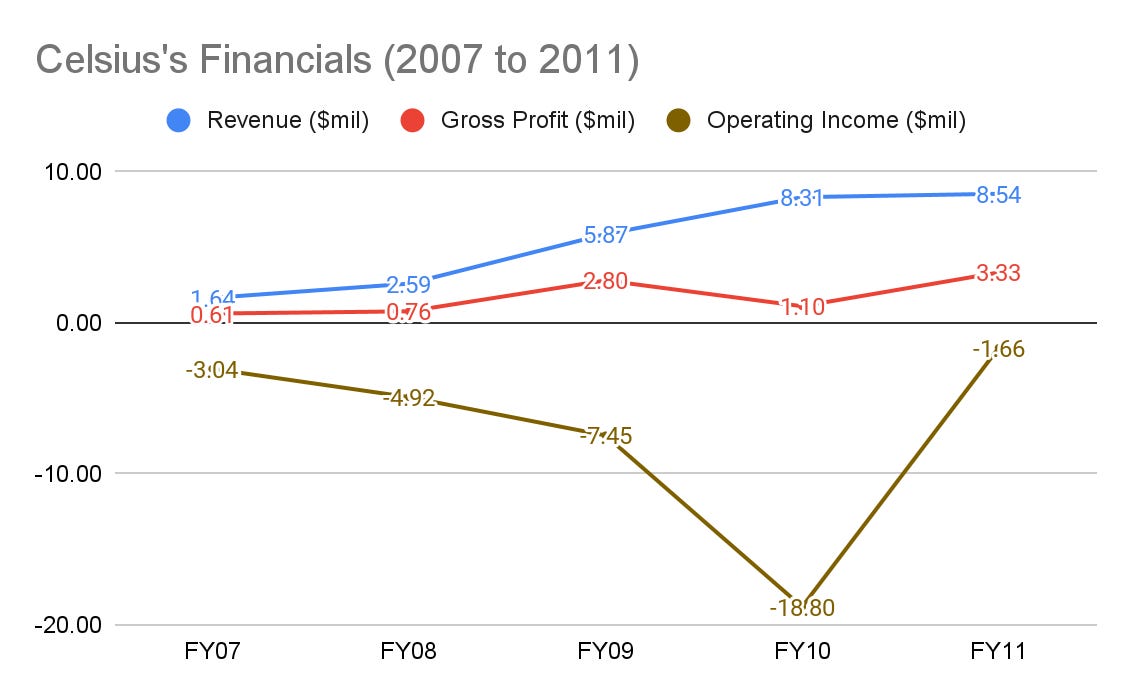

(Source: Sec Gov)

But during those years, the Operating Losses were outrageously high as these sales and marketing (“S&M”) efforts were not translating into revenues for the company. As a result, cash was depleting really quickly.

In 2010, the management decided to reduce their headcounts, reduce marketing expenses, downsize their operations, and remove unprofitable accounts to achieve break-even in 2011 because of the huge losses they had incurred.

This was clearly a case of mismanagement and demonstration of poor capital allocation. And at the end of 2010, they were delisted from the NASDAQ capital market.

While dark clouds seemed to be blooming over its head, there was a white knight who came to its rescue, Carl De Santis, who has been the largest shareholder of the company since 2008. He has played a prominent role in the turnaround of Celsius and has kept the company from the verge of bankruptcy due to its exorbitant cash burn.

Celsius Turnaround: Fix and Build

A New Team

In 2012, after Celsius was delisted from NASDAQ, Carl De Santis leveraged his connection to bring in entirely new management, led by the former CEO and “turnaround king”, Gerry David, and the CFO John Fieldly to lead the turnaround of the company. During the course of the years, they have hired numerous talents like Roberta Kotkosky who worked as a National Account Executive in Coca-Cola for 17 years to lead as the Director of Sales in Celsius.

In 2013, Celsius also appointed new Board members, including Kevin Harrington and Nick Castaldo, who have extensive experience in the consumer beverage industry and in launching successful products. They also added Hal Kravitz in 2016, who was the President of Coca-Cola for 30 years.

We believe to orchestrate a turnaround, a highly competent team is needed to be put in place, and Celsius clearly had an A star team.

When CEO Gerry and CFO John Fieldly came into the company, they undertook various steps to fix up the company.

Rebrand and Repackage

One of the first things that CEO Gerry did is to rebrand and repackage the Celsius drink. In 2012 and 2016, the team re-positioned Celsius as a premium functional energy drink rather than a calorie-burning drink and came up with new designs aimed to target health-minded consumers.

In the Q3’17 earnings call, the former VP of Sales, Vanessa Walker talked about how the previous branding and design did not resonate well with consumers:

“Our rebranding efforts took hold and the brand experience to search a positive consumer and trade feedback has the new package debut on store shelves early January. In mature retailers the year-over-year reorders appear to show double-digit growth…..The classification of diet or calorie burner or just healthy energy alone did not communicate the unique clinically proven attributes and brand benefits Celsius’ proprietary formula provides. Just as tagline Live Fit cause consumers to take action to invest in themselves alternate copy delicious that delivers speak to the brand greatly taste profile and clinically proven ability to deliver the claims made on pack.”

Improve Margins

The new management also placed a lot of emphasis on driving Gross Profit Margin, including optimizing costs to achieve break-even.

That includes relocating their manufacturing and warehousing to improve costs, removing unprofitable accounts like Wholesale Club Costco (NASDAQ: COST) as they weren’t selling well, and executing new social media marketing programs to generate higher sales volume, drive down costs, and achieve profitability.

Focusing On Key Markets

Under the tenure of CEO Stephan, they were spreading themselves too thinly by expanding into many retailers with the aim of achieving broad distribution and brand awareness. Obviously, this strategy did not work as they did not manage to achieve the sell-through rate (i.e. the rate the inventories are selling at) and were “bleeding” profusely.

In addition, consumers also did not resonate well with the brand.

In 2012, after the repackaging, CEO Gerry and the team implemented the “deep drill” model aimed to focus on 5 key regions. They implemented a new marketing program and directed marketing dollars in these regions to gain consumer mindshare, and achieve profitability.

We believe this strategy of concentrating and dominating in a few regions provides a positive feedback loop for the team in experimenting with what works. This can be applied to other regions they expanded into with a higher success rate. For instance, Celsius had a marketing team read the reviews on Amazon.com to understand what consumers like and are looking for.

As they gained consumer mindshare, it becomes easier to innovate new products and roll them out through their existing distributors without spending additional money on marketing campaigns to get them to try their new products. In Q1’17, on top of the original Celsius drink, the company came up with Celsius HEAT and Celsius BCAA whereby both received great acceptance from the retailers.

Successful Turnaround

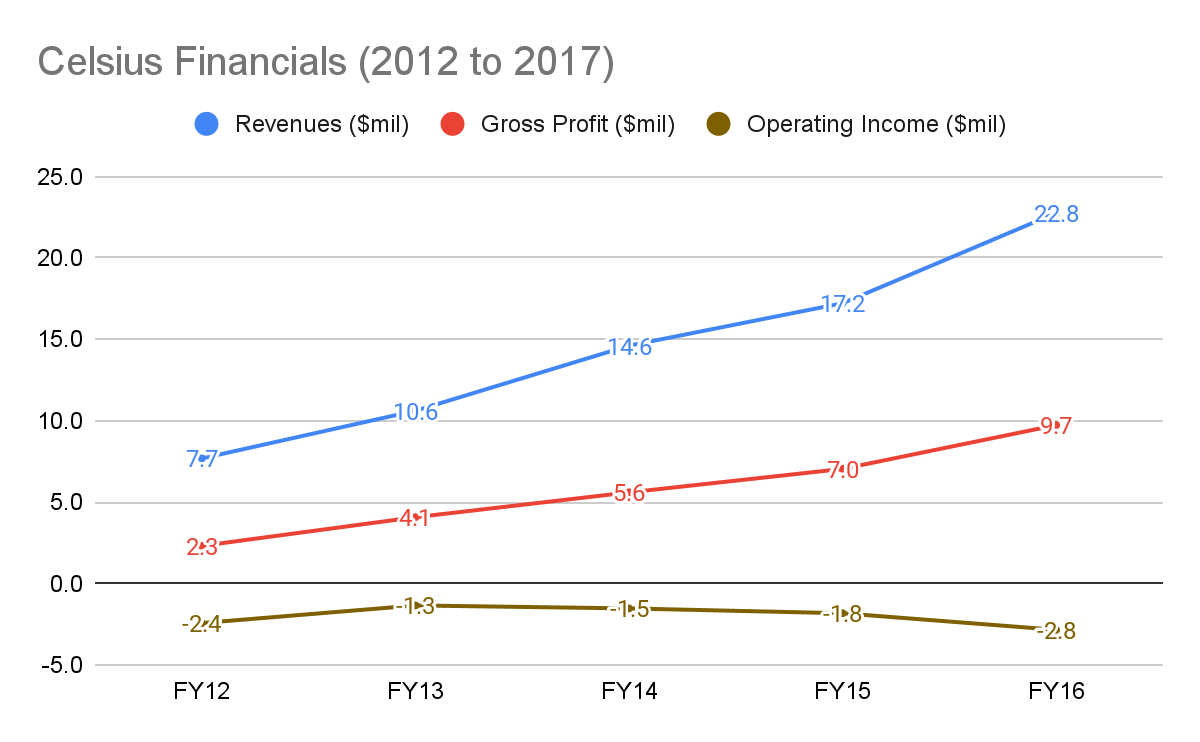

(Source: Sec Gov)

In Q1’17, CEO Gerry retired from the company, and CFO John took over as the interim CEO, which he eventually transitioned into the permanent CEO. Therefore, we look at the course of 5 years (from 2012 to 2016) to see how they had executed the turnaround.

The revenue has grown at a CAGR of 24% while the Gross Profit has grown at a faster CAGR of 33%, demonstrating how successful they were in optimizing costs and driving sales volume to improve Gross Profit Margin (“GPM”).

The Operating Losses were negligible and relatively stable over the years. In fact, during the Q2’16 earnings call, CEO Gerry spoke about how they already turned profitable but they chose to sacrifice short term profitability to pursue growth:

“..We're really trying to achieve faster revenues as quick as we can and higher revenues. Because that also helps us drive down costs of goods. It's like a domino effect. We could, and I'll make this statement. We could run this business like we demonstrated in Q4 of '14, Q1 of '15, where we were profitable as a company after 10 years we've demonstrated that we could run this business profitably. Then Q2 of '15 we were cash flow positive. But, we then made conscious decision to really start investing in the business and putting money back in. We could just this business today as a profitable business, but it will grow much slower.”

In addition, Celsius’s improving fundamentals and one-of-a-kind product have managed to attract and land a $15 million investment led by Mr. Li Ka-Shing of Horizon Ventures in 2015, which allowed the management to spearhead their growth.

After CEO Gerry retired in 2017, he passed on the helm to CFO John, who managed to get Celsius uplisted in the public market in Q2’17 again and lead the company from a turnaround to a growth company.

Turnaround To Growth Company

Increasing Distribution Footprint

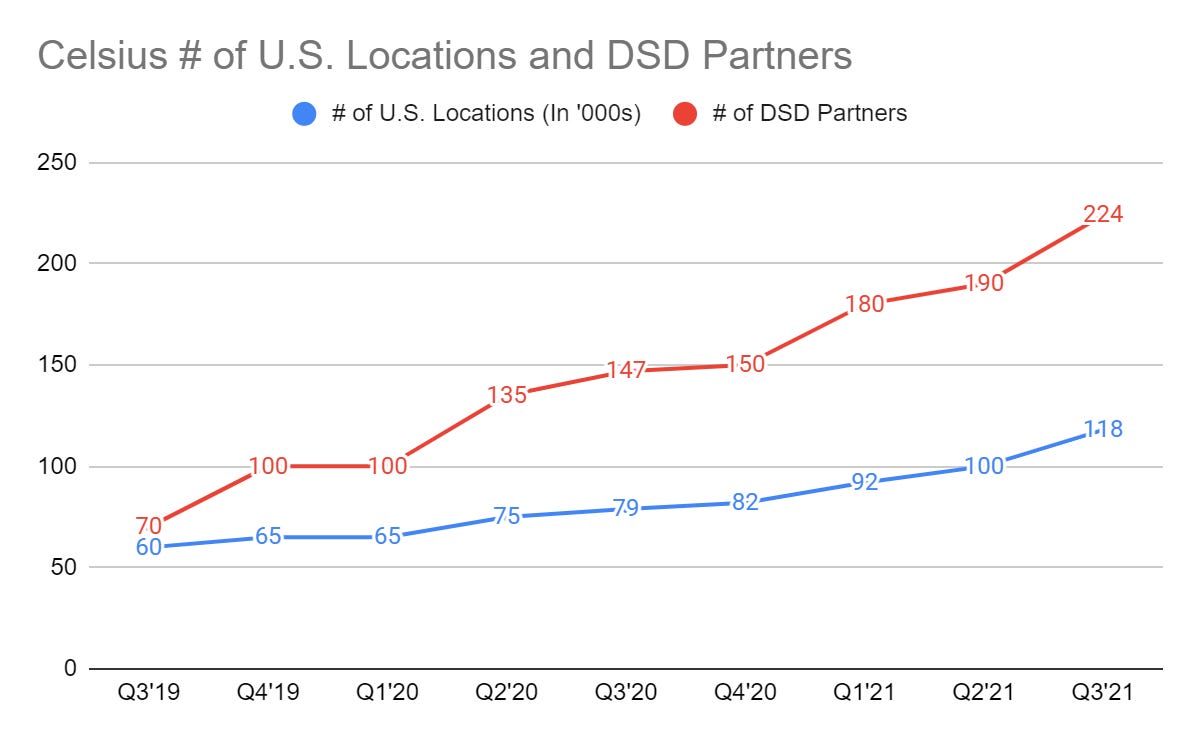

(Source: Celsius IR)

Celsius mainly expands its distribution footprint through a direct-store-delivery (“DSD”) model, whereby distributors like Big Geyer, Keurig Dr. Pepper, and MillerCoors will distribute their products on their behalf to the retailers. DSD partners help Celsius to expand their in-store presence, make sure that their products are properly placed (i.e. on the shelves & coolers), and ensure they are always in stock.

Great product placements lead to increased product visibility, therefore, increasing the chances of them selling out.

Previously, Celsius was using a wholesale direct model, but it was causing a lot of bottlenecks as their products were selling too quickly, and they couldn’t get them to re-stock in time. According to the management, transitioning to the DSD model saw sales more than double for their key accounts.

As of Q3’21, 50% of their retailers have transitioned into the DSD model and their longer-term goal is to achieve 80%. DSD network also recorded revenue growth of 429% during the quarter.

Besides penetrating the offline retailers, Celsius also leveraged e-commerce channels like Amazon.com. Today, they are the second-largest energy drink on Amazon beside Monster Beverage (NASDAQ: MNST) and Red Bull, which is an impressive fit.

(Source: SeekingAlpha)

In Q3’21, Celsius had 224 DSD distribution partners and their products are located at over 118,000 locations, and these numbers are still growing today. Partnering with more premier great DSD partners allows the company to extend its products to more retailers, maintain its positioning on the shelves, and thus, grab more market share.

As CEO John mentioned during the Q4’18 earnings call, Celsius is gaining great product placements as they are outselling the other larger brands that are not aligned with today’s health-minded consumers, paving the way for Celsius to disrupt the traditional energy drink category that is bogged with sugary drinks.

Rapidly Growing Product Portfolio

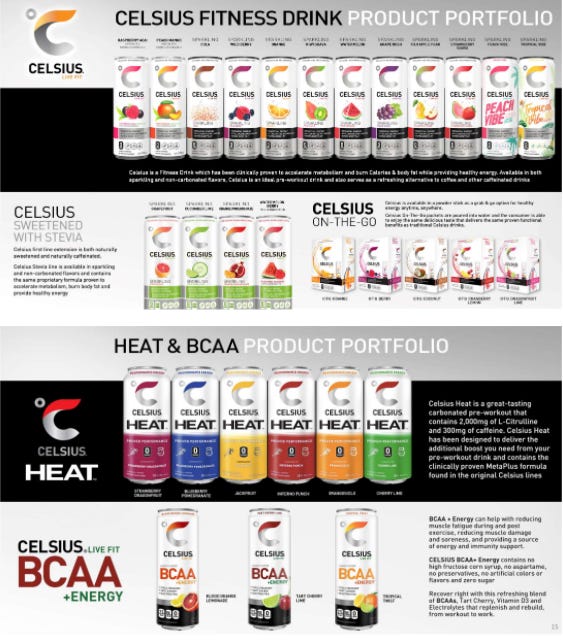

(Source: Celsius IR)

Today, Celsius consists of a wide range of products portfolio, including their original line, Celsius Fitness Drink.

One of the key strategic components is innovating new products and flavors as it helps to strengthen the consumers’ mindshare and to reach more users. Because Celsius has achieved global brand recognition, they are able to roll out new products via their DSD strategy with little to no marketing spend to get consumers to try.

According to CEO John in the Q2’19 earnings call, adding more SKUs results in significant sales:

“...we have additional opportunities to expand or expand our portfolio to 2, 4, 5, 6 and full shelf execution where we know when we increase additional SKUs the velocity numbers not just increased by one SKU, they increase on a multiplier effect…”

And over the years, Celsius has also mastered the ability to come up with new products or flavors that consumers will enjoy, in the Q4’19 earnings call, CEO John stated that their last several flavor launches have been spot-on on what consumers want.

This is also what’s coined as an octopus-like business model. An expanding product coupled with a great distribution network allows Celsius to scale and expand rapidly.

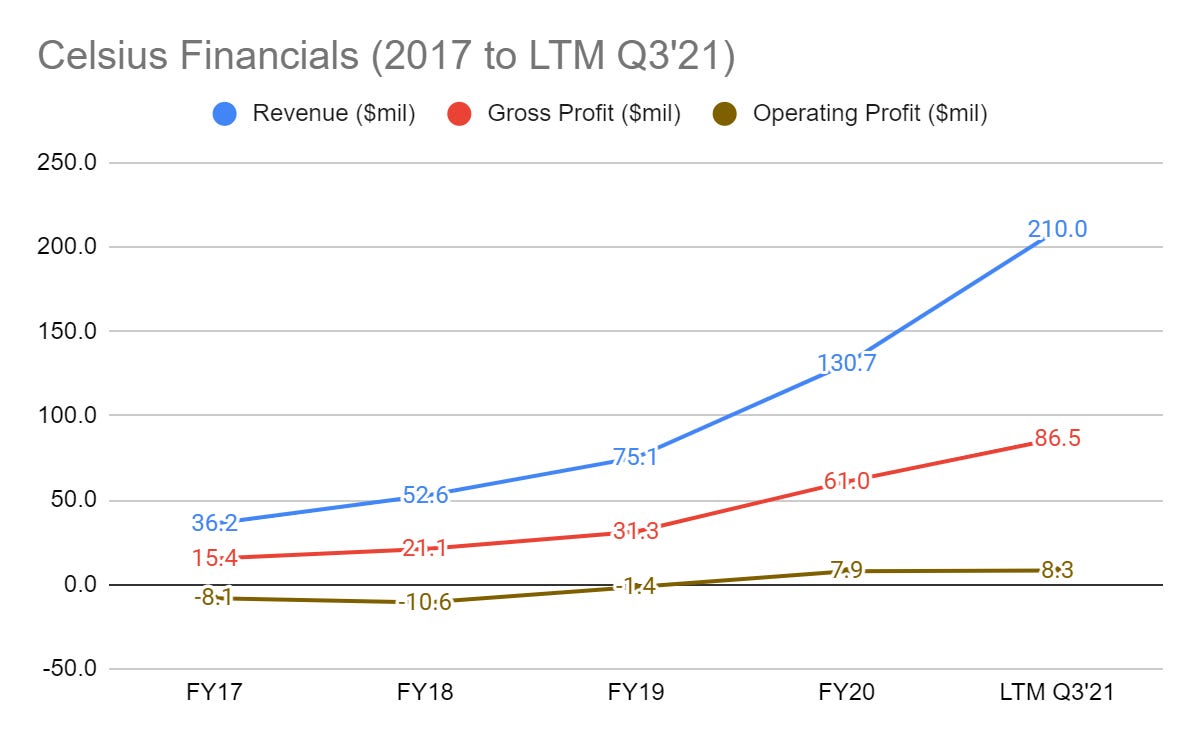

Financials

(Source: Sec Gov)

Since CEO John took over the helm, Celsius has shown robust growth in which its revenue and Gross Profit grew at a CAGR of 42% from 2017 to the LTM Q3’21.

The revenue growth was driven by the growing brand recognition, the addition of new stores, product expansion, and more retailers continuing to transition into the DSD model which resulted in higher sales volume. Higher sales volume translates into higher Gross Profit and Gross Profit Margin (“GPM”) due to economies of scale.

Celsius sales were also extremely resilient during the pandemic in 2020, showing that consumers continue to drink Celsius on a regular basis and they shifted their purchase decision to channels like e-commerce.

Operating Profit has also improved tremendously over the years due to the inherent Operating Leverage that resides in the business, and this eventually led to the company being profitable.

This clearly shows that despite having a financial background, John Fieldly was able to learn the ropes alongside CEO Gerry, and that has enabled him to successfully execute and bring Celsius to even greater heights. This may also dispel the stigma that a CFO is not capable of leading the company, and John Fidelity is a prime example of it.

Conclusion

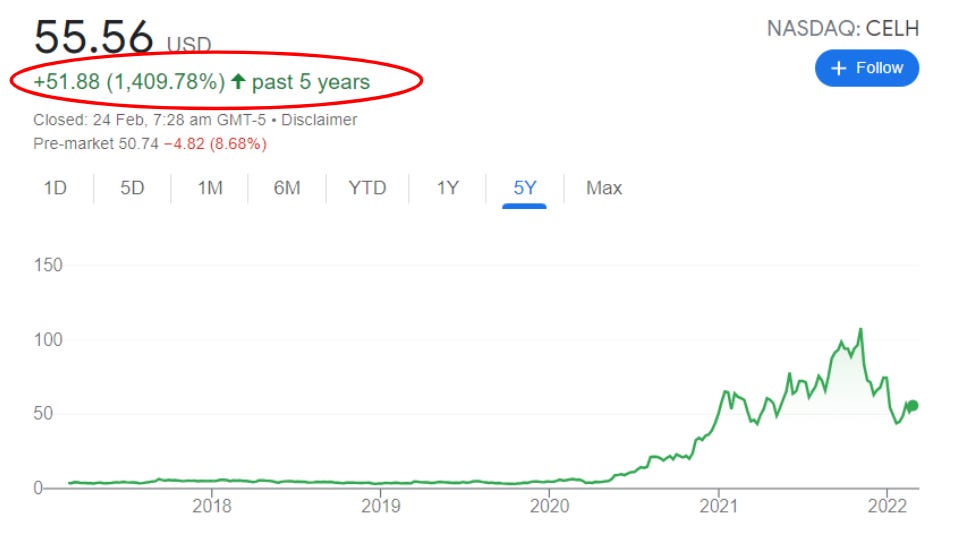

(Source: Google)

Since CEO Gerry David and CFO John Fieldly took over, they have managed to turn around the business and transformed it into a growth company that delivered a staggering 1,420% returns over a 5 years period for their shareholders.

(Source: TIKR)

The returns are driven by the twin-engine – improving fundamentals (i.e. increasing revenues and earnings), and multiple expansion. This means that for a period of time, the stock went nowhere and it requires shareholders to sit tight knowing that there was a huge disconnect between the business fundamentals and the share price in order to realize the returns.

But this is easier said than done.

This would not have been possible without the “white knights” in the company, Carl De Santis, who play a prominent role in the turnaround of the company, and the $15 million investment by Mr. Li Ka-Shing to provide the management that extra bullets to accelerate their growth plans.

Celsius is truly a one-of-a-kind incredible turnaround story.

This was great, thank you for sharing!